Balance sheet is simple but powerful tool to improve your financial health and grow your net worth. It lies at the core of any enterprise. Balance sheets are used by managements and investors for making important financial decisions that lead growing the worth of organisations. Now, you also generate money through salaries and have expenses for living. Then why shouldn’t you have a personal balance sheet to know your financial health?

At least that’s what we wanted to know, hence we created our personal balance sheet. On its face value a balance sheet is just a collection of number. The secret lies in the ability to understand what they signify and acting on the insights they provide. We used it to reduce our expenses by 10% and put us on a path of increasing our net worth by more than 20%. And here is how we did it?

What is Personal Balance Sheet?

Let’s leave the complexities of enterprise balance sheets to the accounting experts and focus on you as a person. A personal balance sheet and for that matter any balance sheets essentially shows the balance between income, expenses, assets and liabilities. Hence it is an effective way to track a your financial health and net worth. It will help you understand your day-to-day spending and make better financial decisions.

Why you need a personal Balance Sheet?

Having a personal balance sheet can be an eye opener. This will surely help you to understand your financial situation and where you are spending your money, identify areas in which you are overspending or underspending, identify areas of your life in which you may need to make changes, track your progress and make necessary adjustments along the way.

And above all make smarter financial decisions when you are aiming for ambitious goals like financial freedom.

How to Create Your Personal Balance Sheet?

Step 1: Collect Information

We have modified a classic balance sheet which would typically represent the assets and liabilities part to add some information about your cashflow i.e. income and expenses. We also refer to it as our financial framework. To create this personal balance sheet, you need to define a timeframe such as annually or quarterly. Then gather all your financial information from bank statements, mortgage documents, credit card reports, insurances, brokerage accounts, retirement plans, loans etc. (Link to Checklist) Many banks allow you to download this information in editable formats like .csv or .xlsx.

For us this was the most tedious part. Especially when doing it for the first time. But trust us on this, it is worth the effort. And it is hard only the first time.

Step 2: Allocate the information

Allocate the collected information in each quadrant as follows:

Incomes: Sum of all incomes you have from salaries and/or other investments.

Expenses: Sum of all expenditures during the timeframe.

Assets: Any object generating revenue, stores or appreciates in value – ideally without you having to put in additional work.

Liabilities: Objects depreciating in value or committed expenses without contribution towards assets or income. For mortgages, though EMI is a liability, but the interest is the actual liability as it costs money without improving your equity on the underlying asset.

Once you have allocated the information you collected to the four quadrants, you have a snapshot of your current financial health. Essentially you have a personal balance sheet. Subsequently you can start analysing the information.

What is Your Balance Sheet Telling You?

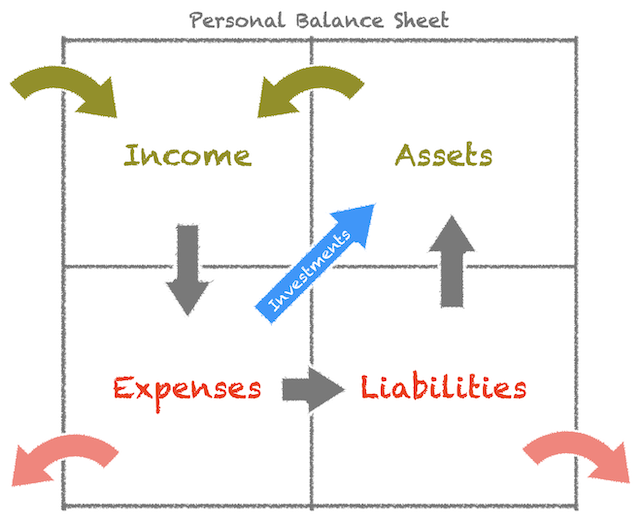

From Income the cash flows into different transactions for fulfilling the commitments. For ease of understanding we put “any” expenditure in the expenses block. The remaining unused is your surplus but if this is negative i.e. your expenses are higher than income you have a deficit.

The difference between your assets and liabilities is your current net worth.

In the expenses block there are 3 kind of expenses i.e. expenses which flow out without any impact on assets primarily cost of living and discretionary expenses; expenses which go towards fulfilling liabilities and expenses which flow directly towards building assets we call them “Investments”.

We have divided liability costs into 2 categories – cash you loose through payments without improving the assets such as interests, depreciations etc. and the cash which contributes towards improving the equity in assets.

How to Grow Your Net Worth?

Since net worth is the difference between assets and liabilities hence growing it simply translates to growing you assets while reducing your liabilities. Easier said than done, right.

Here is how we achieved our results:

Boosting income: We looked at ways for boosting our income through better jobs (it worked out) and building sources to append our income. (Here are 5 ways of generating passive income.)

Reducing expenses: On careful consideration of our current expenses we identified many places where we could cut down on. Does it have to be the expensive vacation? Do you need so much stuff? Do you need Spotify, Apple Music and Amazon Music all at the same time? (Here are 5 things eating away your money)

Doing the above created additional surplus for us. This we simply diverted as investments towards our assets bucket.

Reduce Liabilities: Buy assets not liabilities. Invest in things which keep their value, they might be expensive to acquire but you will enjoy them for a much longer time and in the end they will also contribute to your net worth. For me, I am fond of watches and in the past i used to buy one which bought my eye. Two years later I was not wearing them and selling them would not get me any money. This changed 6 years back. I started to save up and buy watches which kept their value, some even appreciated. But you get the idea. Another things is to pay-off loans as soon as possible. Remember the interest you are paying, its money simply draining out without any returns.

In a nutshell, maximise the upper half and minimise the lower half of your Personal Balance Sheet.

In Conclusion

- Since balance sheets are snapshots of your financial health they need to be updated at regular intervals to see the changes.

- Understand the mechanics. Your net worth is simply the difference of the second column (Assets – Liabilities).

- Idea is simple – Increasing the upper while decreasing the lower half.

- Create assets which can generate cashflows.

- Set yourself an achievable goal and stay committed. Have patience as you are in for a long haul.

Pingback: 5 Simple Steps To Financial Independence - Awesome but Simple

Pingback: 5 Things that Are Eating Your Money Away - Awesome but Simple

Pingback: An asset or a liability? - Awesome but Simple

It is in point of fact a nice and useful piece of info. I am satisfied that

you simply shared this helpful info with us. Please keep us up to date like this.

Thank you for sharing.